The latest quarterly bulletin by the Capital Markets Authority (CMA) indicates that Uganda’s capital markets activity demonstrated improved performance during the period ending September 2024.

The report shows that in September 2024, CIS Managers had Ugx 3.51 trillion (US$ 945.4 Million) in assets under management, representing a 10.5% increase from Ugx 3.18 trillion (US$ 855.7 Million) in June 2024. The AUM grew by 54.1% year-on-year when compared to September 2023, rising from Ugx 2.3 trillion (US$ 613.4 Million). Furthermore, the number of funded CIS accounts reached 103,950 in September 2024, a 12.8% increase from 92,165 in June 2024. This growth in AUM and accounts can be attributed to greater investor awareness of the benefits of investing through CIS, the midterm access to National Social Security Fund savings (some of which have been invested in CIS), and strong regulatory protection that has boosted investor confidence.

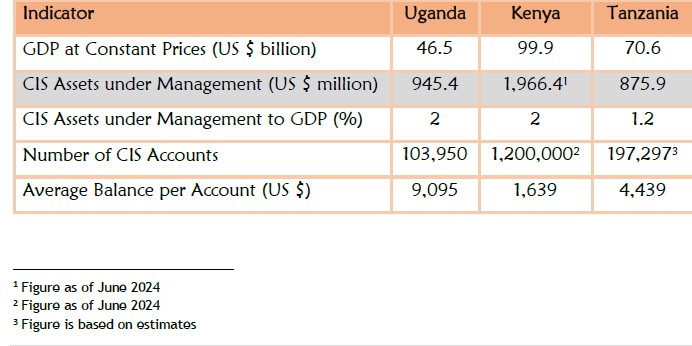

Across the region, Kenya leads East Africa with CIS AUM of $1,966 million, followed by Uganda (see Table I).

Table I: Comparison of Number of CIS Investor Accounts and CIS AUM as a Percentage of GDP as of September 2024 Indicator Uganda Kenya Tanzania

Source: CMA Research & Market Development Department; World Bank; Capital Markets Authority Kenya. (2024). Quarterly Statistical Bulletin; https://www.uttamis.co.tz/

Josephine Okui Ossiya, the Chief Executive Officer of the Capital Markets Authority, commented on the growth observed in the CIS sector. “Ugandans are recognizing the benefits of investing through pooled savings vehicles. The regulatory framework has instilled confidence among investors, who are assured of the protection afforded by investing in regulated financial products, such as CIS. I would like to encourage more Ugandans to invest in CIS’’, she said.

CMA was established in 1996 by the CMA Act Cap 64. The Authority has several functions under this Act, including; of the capital markets; protection of investors, and management of the investor compensation fund.

The CMA Act prescribes the following as the functions of the Authority:

•To approve prospectuses and other offering documents under which securities are offered to the public and to approve information memorandum;

•To develop all aspects of the capital markets with particular emphasis on the removal of impediments to, and the creation of incentives for,long term investments in productive enterprise;

•To create, maintain and regulate, through implementation of a system in which the market participants are self-regulatory to the maximum practicable extent, of a market in which securities can be issued and traded in an orderly, fair and efficient manner;

- Advertisement -