Gift Shoko, Managing Director of Equity Bank Uganda, has re-affirmed that the future of banking is not just about banks but more about strategic partnerships and shared infrastructure with FinTechs to provide seamless banking experiences.

“Equity Bank sees FinTechs not just as clients but as partners in driving financial inclusion, fostering innovation and creating efficiencies for businesses and communities across Africa,” he said.

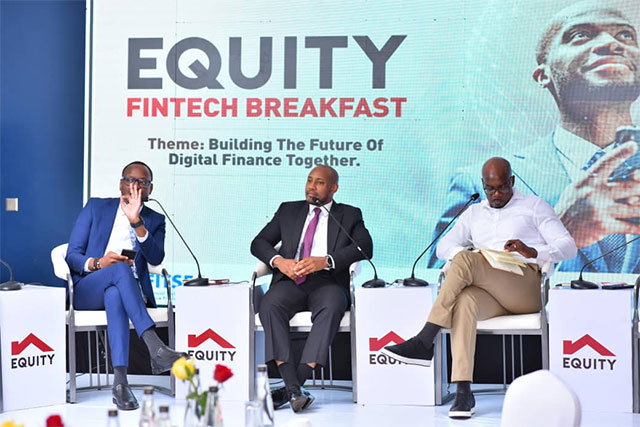

This was last Friday when Equity Bank Uganda in collaboration with the Financial Technologies Service Providers Association (FITSPA) successfully hosted an exclusive Fintech Engagement Breakfast at Golden Tulip Hotel, Kampala.